China's Great Gamble: Is Silver Next?

in response to

by

posted on

Jul 01, 2016 01:32AM

Submitted by John Lee on Thu, 06/23/2016

First stocks, property, commodities and now Bitcoin. Then silver...?

The ROULETTE game all started in the fall of 2014, about 2 years after Chairman Xi Jinping came to power and became the General Secretary of the Communist Party of China, writes John Lee of Prophecy Dev.

As reported by China Daily Asia on September 5, 2014:

"State-run media in China are trying to do something the securities industry has failed to accomplish for much of the past three years: get the world's biggest population to buy more stocks.

"The Xinhua News Agency published at least eight articles this week advocating equity investing after similar stories appeared in the People's Daily newspaper and on State-run television last month, part of what Everbright Securities Co said is an increased government push to bolster the market. Authorities have also cut trading fees, made it cheaper to open new accounts and organized investor presentations by the biggest listed banks..."

The banks started margin lending, a practice that's has been prohibited since 2007.

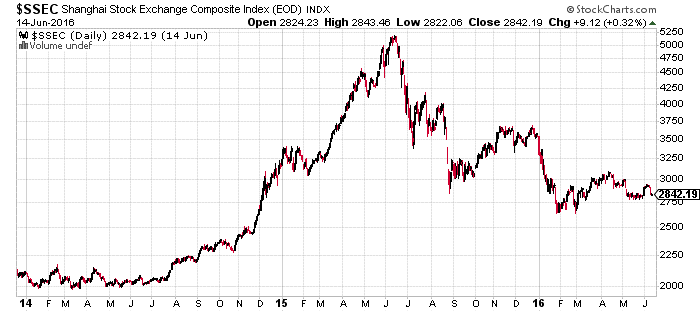

The results speaks for themselves:

Trading commodities in China – also the world's biggest consumer of raw materials – is relatively straightforward.

To set up a commodity futures brokerage account in China, an individual needs to provide their identity, in some cases with a video verification, and bank details. A deposit is needed to start trading.

Morgan Stanley estimates 160,000 new accounts were set up online between July 2015 and February 2016. Individual investors tend to be most active when markets are rising, and have dominated past rallies in Chinese futures.

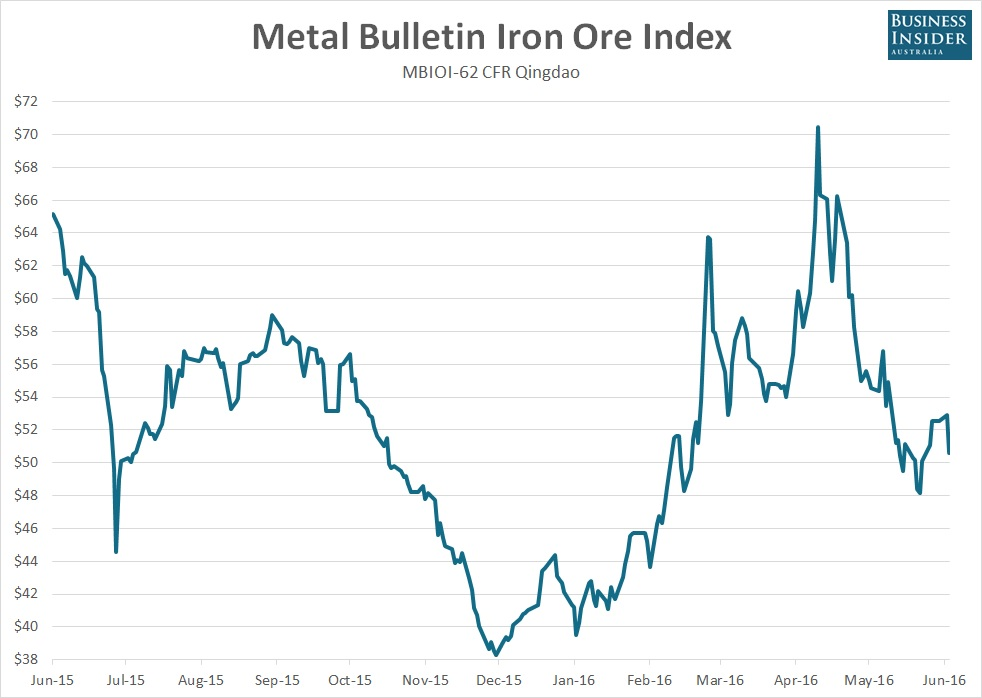

The following chart speaks to Chinese investment speculation:

According to an article published by Business Insider Australia on March 9:

"...the equivalent of 977 million tonnes were traded on the Dalian exchange on Wednesday [March 9, 2016]. Not only was it the highest daily turnover on record, it exceeded the entire amount of physical iron ore imported by China over the past year.

"In the 12 months to February, China imported a total of 962.6 million tonnes of an iron ore, the largest year-on-year total on record.

"If the level of turnover recorded in Dalian futures on Wednesday was to be replicated over the course of any one typical trading year, it would equate to around 240 billion tonnes of ore."

The annual world production of iron ore was 3.22 billion tonnes in 2014, according to Wikipedia.

According to a Bitcoin Magazine article dated May 31, 2016:

"Huobi and OKCoin, the two largest Chinese exchanges that now account for some 92% of Bitcoin global trading by (self-reported) volume, both reported almost double the usual trading volume over the past weekend. BTCC, China's third largest exchange, also reported a surge in bitcoin trading volume, setting a new record on its Pro Exchange."

Huobi's CEO, Leon Li said that: "More and more Chinese investors and their hot money need a new investment market, and a convenient alternative investment like Bitcoin is easy to be accepted by the traders."

Curiously, if a crypto-currency without intrinsic value can muster such popularity, why not speculate on gold and silver? Particularly silver, as it stands out as a "poor man's gold", ideal for action seeking, trigger-happy Chinese investors.

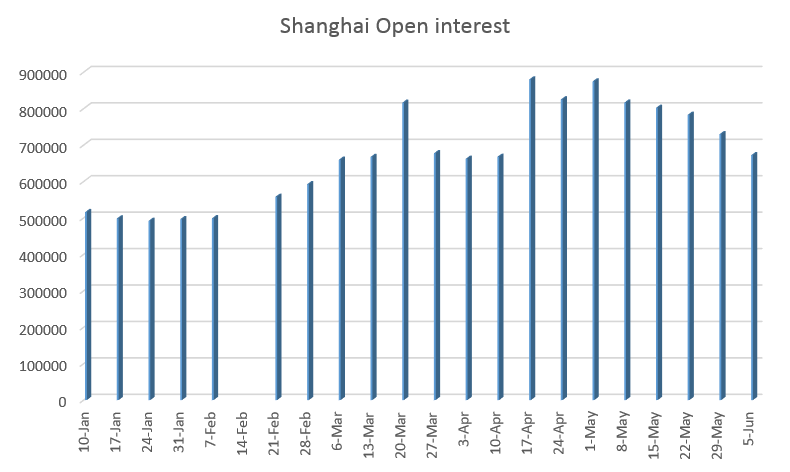

Indeed, open interest in silver on the Shanghai Futures Exchange has been steadily increasing this year, with open interest now roughly equal and equivalent in size to that of COMEX.

Shanghai Futures Exchange Silver contract open interest:

The contract size is 15kg, roughly 500 Troy ounces, or 1/10 of the COMEX silver contract size (5,000 oz). The open interest ballooned from less than 200,000 contracts in 2012 to over 600,000 since April 2016.

What is the take-away?