U308 Corp. Highlights Planned Production Profile for Vanadium from The Laguna Salada Deposit Based On A PEA.

posted on

Sep 14, 2017 10:47AM

Edit this title from the Fast Facts Section

Thursday, September 14, 2017

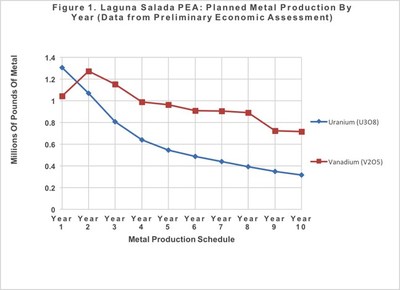

TORONTO, Sept. 14, 2017 /CNW/ - U3O8 Corp. (TSX: UWE), (OTCQB: UWEFF) ("U3O8 Corp." or the "Company") highlights the production schedule from the Preliminary Economic Assessment ("PEA") on its Laguna Salada Deposit, in which almost twice as much vanadium would be produced as uranium.

"Vanadium prices have risen strongly in response to a supply shortfall that has been developing in the vanadium market," said Richard Spencer, President & CEO of U3O8 Corp. "The trigger for the recent sharp price increase was a change in policy in China that resulted in restricted access to vanadium slag and higher local production costs, coming on the back of increasing vanadium consumption, notably from the steel and battery industries. Based on a vanadium pentoxide price of US$5.50 per pound, the 0.8mlb to 1.2mlb vanadium production per year estimated in the PEA would contribute 12% of the Laguna Salada Project's revenue. Vanadium pentoxide is now trading at over US$12 per pound. In addition, Argentina paid an average of US$58 per pound for imported uranium last year, only marginally below the US$60 per pound price used in the economic analysis in the PEA".

Production Schedule

The mining schedule defined in the PEA on Laguna Salada starts with production from the richest part of the Deposit so that revenue would be maximized so that the capital required to develop the Project would be paid back as quickly as possible – in two and a half years as per the current PEA. Uranium production would be over one million pounds ("mlbs") per year over the first four years and then would decline gradually, averaging 0.6mlbs over the life of the mine (Figure 1). Argentina's current uranium demand is approximately 0.55mlbs per year to fuel its three reactors.

Vanadium production would be relatively constant at between 0.8mlbs and 1.2mlbs per year over the life of the mine that was planned on the basis of the initial resource (Figure 1).

Higher-grade uranium and vanadium encountered in channels at the base of the gravel layer in recent exploration (results reported on January 11, 2017, January 19, 2017 and February 7, 2017), and not included in the PEA, adds upside potential to the Project.

Vanadium Supply-Demand Scenario

The vanadium market slipped into deficit this year with demand outstripping supply for the first time in a decade (Figure 2). Vanadium prices have responded to this structural change in the market by strengthening – the sharp increase over the last few months having been triggered by new Chinese regulations that restrict the importation of vanadium slag, the processing of which produced pollutants (Figure 3). Supply was further impacted by production cuts from Sichuan Province in China in September and the importation of a larger proportion of iron ore that does not contain significant vanadium. Demand for vanadium in China is expected to increase about 30% (not yet incorporated in Figure 2) in response to new regulations implemented to make buildings more resistant to earthquakes through the use of vanadium steel rebar; the addition of one kilogram (approximately two pounds) of vanadium to a tonne of steel doubles its strength.

Next Steps

The metallurgical test work on Laguna Salada indicates that a greater proportion of the contained vanadium could be extracted from the gravel and work is planned to support this potential.

The Company is focused on finding ways of reducing both capital and operating cost estimates. Examples of possible capital cost reductions include using pre-owned "belly-scrapers" from the road-building and construction industry instead of sophisticated and expensive continuous miners to mine the flat-lying, unconsolidated gravel, and installation of used equipment for beneficiation to remove the barren pebbles from the uranium-vanadium – bearing fine sand. In addition, the preference of the Argentine nuclear fuel enrichment facility to use ammonium diurinate, instead of yellowcake, as feed for its enrichment facility, would lower the capital cost estimate for the Laguna Salada Project by approximately 5% through the elimination of the calcining module from the plant design. A pilot plant would aim to refine capital and operating costs for both the production of ammonium diurinate and yellowcake.

Technical Information

Cautionary Note: the Preliminary Economic Assessment is preliminary in nature, and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the results of the PEA assessment will be realized.

Dr. Richard Spencer, P.Geo., CGeol., President and CEO of U3O8 Corp. and a Qualified Person as defined by National Instrument 43-101, has approved the technical information in this news release relating to the Laguna Salada Deposit and the related PEA.

About U3O8 Corp.

U308 Corp